kane county illinois property tax due dates 2021

Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021. Welcome to the Kane County Treasurer E-Notify Service.

News Flash Westmont Il Civicengage

The County Clerk tax staff calculates the tax rate set within statutory limits by the local board for each taxing district t o each propertys valuation set by the Township Assessor.

. Tax Year 2020 First Installment Due Date. When Are Property Taxes Due In Kane County Illinois Homeowners In Collar Counties Pay Highest Property Taxes In Illinois Kilbourne announced today thursday april 22 2021 that kane county property tax bills will be mailed on. Friday October 1 2021.

Property taxes are paid at the Kane County Treasurers office located at 719 S. We are open during the hours of 800 am to 430pm Monday thru Friday except for holidays. You may sign up with your email address to receive installment due date reminders and payment notifications for.

And Have a total household income as defined below no greater than 65000 in 2020. Tax Year 2020 Second Installment Due Date. County officials will conduct a tax sale on Feb.

The Kane County Board of Review was notified of the appeal on July 1st 2021 and granted a 90-day extension to submit evidence with a due date of September 29th 2021. Tuesday March 2 2021. The levies for each local taxing body are set by each Kane County Unit of Governments governing board.

KANE COUNTY TREASURER Michael J. The Kane County Treasurers Office has posted a notice on its website saying unpaid Kane County property taxes are now considered delinquent. Assistance in filling out these forms is available by telephone only at.

630-208-7549 Office Hours Monday Thru Friday. Friday October 1 2021. 2017 Effective Property Tax Rates In The Collar Counties The Civic Federation We are open during the hours of 800 am to 430pm Monday thru Friday except for holidays.

Second Installment Due Date. But that still gives delinquent taxpayers an opportunity to make their property tax payments. Kane County collects on average 209 of a propertys assessed fair market value as property tax.

Contact your county treasurer for payment due dates. First Installment Due Date. Kane County Government Center 719 S.

And was granted a 90-day extension to submit evidence with a due date of June 2 2021. The first installment will be due on or before June 1 2021 and the second installment will be due on or. Kane County Property Tax Inquiry.

Silver Oaks at Waterford LP. Kilbourne announced today thursday april 22 2021 that kane county property tax bills will be mailed on. Tax Bill Is Not Ready.

Be 65 or older by December 31 2021. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

3315 - BUONA ST. In most counties property taxes are paid in two installments usually June 1 and September 1. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000.

Tuesday March 1 2022. 20 - 423-429 E CHICAGO STREET CONDO. You may pay your real estate taxes in person at the Kendall County Collectors Office.

Late Payment Interest Waived through Monday May 3 2021. For each Public Act we have provided reference to the Illinois Property Tax Code 35 ILCS 2001 et seq. The requested tax bill for tax year 2021 has not been prepared yet.

The contents of this notice are informational only and do not take the place of statutes rules or court decisions. Or Visa Debit card until Friday. Personal or Business checks are accepted until Friday September 24 2021.

We are located at 111 West Fox Street Yorkville on the 1 st floor Room 114. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. 19-02258-C-2 Kane Home Depot USA Inc.

Once taxes for the selected year have been extended the tax bill will be available. CHARLES OFFICE CONDO AMEND PER 2015K018901. Be 65 or older by December 31 2021.

The exact property tax levied depends on the county in Illinois the property is located in. County Assessment Office All of Kane County 6302083818 MF 830 am430 pm. A convenience fee of 235 will be added.

Kane County Treasurer 719 S. MasterCard credit or debit Discover Visa or American Express cards. Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes.

2021 Legislative Updates to the Property Tax Code. According to the Treasurers Office website payments must be. Tax Year 2021 First Installment Due Date.

We also have a drop box located outside where you can drop of your payments anytime. Important Dates to Remember. Bldg A Geneva IL 60134 Phone.

3164 - COURTYARDS OF. 3317 - COURTYARDS OF ST. On May 27 2021 the Kane County Board of Review requested the PTAB grant an additional extension of time to review and complete evidence to file for these appeals.

Batavia Ave Bldg A Geneva IL 60134 630-232-3400.

Illinois Legislators Move Primary Date Chicago News Wttw

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Homes Sold Fast In January As Demand Remains High Illinois Realtors

Reminder Ilrpp Rental Assistance Applications Must Be Submitted By 11 59 P M Sun Jan 9 2022 Illinois Realtors

Illinois Budget Includes 1 Billion In One Time Relief For Grocery Gas Some Property Taxes Kane County Connects

Illinois Sales Tax Guide And Calculator 2022 Taxjar

3243 W Sunnyside Ave Unit 2w Chicago Il 60625 2 Beds 1 Bath Sunnyside Chicago Chicago Events

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

Illinois Doubled Gas Tax Grows A Little More July 1

How To Appeal Property Taxes In Geneva Il Beautiful Places Valley View Chicago Suburbs

Deadline Approaching For Seniors To Apply For Property Tax Deferral Program Kane County Connects

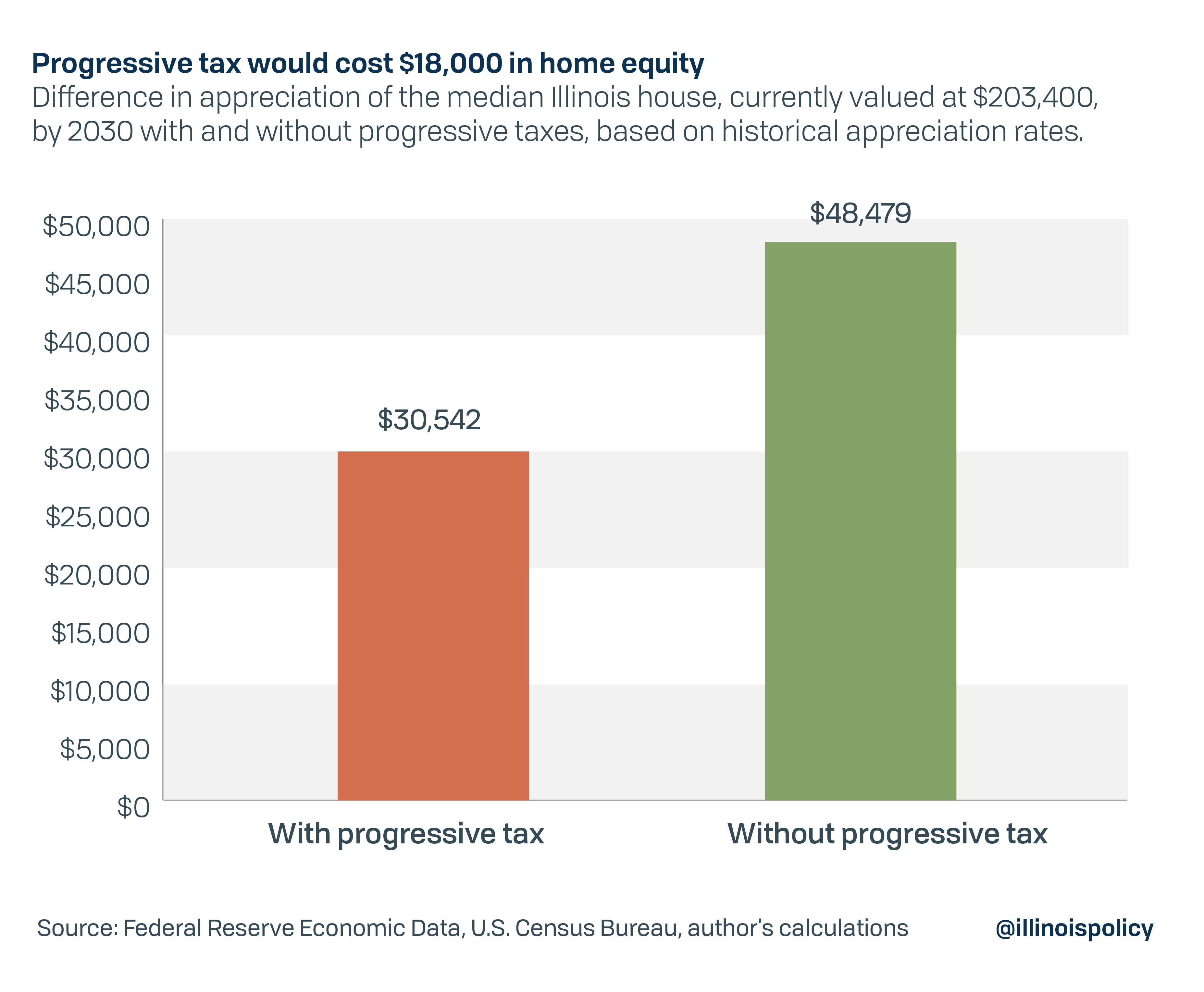

Progressive Tax Could Cost Nearly 1 800 A Year In Home Equity Illinois Policy

2021 Illinois Tax Filing Season Begins Friday Feb 12 Kane County Connects

Devnet Incorporated Home Facebook

Illinois Homes Sold Fast In January As Demand Remains High Illinois Realtors

How To Pay Your Property Tax Bill In Kane County Il Kane County Connects